Innovative Automaker Adopts VR for Collaborative Design Efforts

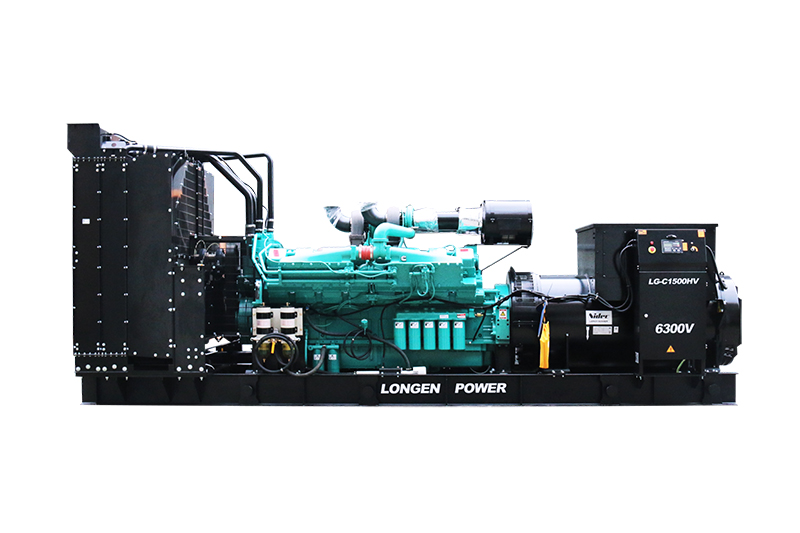

Power Generator for Military Market Outlook (2023 to 2033) Mobile Generator Trailer

The global power generator for military market size is predicted to reach US$ 1,127.1 million in 2023 and further expand at 3.6% CAGR. Total military power generator sales are set to rise at a steady CAGR between 2023 and 2033, totaling a valuation of US$ 1,605.3 million by 2033.

By 2033, the top five companies are projected to hold a significant share of the military power generator industry. Based on the capacity, up to 60 KW generators are set to create lucrative growth opportunities in the global market. This is due to their portability size and instant power generation ability.

During the projection period, the global market for military power generators is predicted to increase by 1.45x times its present level.

In 2023, the global market for military power generators is expected to account for about 3% to 6% of the worldwide generator sales market. FMI estimates the global generator sales market to reach US$ 32.2 billion in 2023.

In recent years, power generators have become essential equipment across the thriving defense and military industry due to their numerous applications. These power generators have become ideal backup power systems at military bases and other critical locations. This is due to their ability to provide a reliable power supply during a grid outage.

The increasing need for uninterrupted and reliable power sources for successful military operations is acting as a catalyst triggering the development of power generators for military industry.

Increasing spending on military and defense coupled with surging demand for advanced power generation solutions that can provide continuous and constant power supply is expected to boost military power generator sales.

Robust development of military bases in nations such as the United States, China, Russia, and Germany is expected to drive up demand for power generators for the military.

In the field, where it’s difficult to transport a bulky generator to areas such as hills and water boundaries, armed forces rely on lightweight, portable generators. Hence, the growing popularity of mobile and portable generators in military applications is expected to create lucrative growth opportunities for military power generator manufacturers.

Advancements in military generators and the development of compact tactical power generators are projected to boost military power generator sales through 2033. Subsequently, shifting preference towards eco-friendly power generators is expected to bode well for the market.

Currently, diesel generators remain the top-selling category. However, with tightening environmental laws due to increasing air pollution levels, demand for natural gas generators is expected to rise at a high pace during the projection period.

Increasing usage of thermoelectric generators for specific military applications due to their compact & lightweight construction and quiet operation is expected to further boost the market.

Leading military power generator manufacturers are focusing on developing innovative power generators with better efficiency, low carbon footprint, and reduced size. They are getting new assignments and projects from several military organizations for developing customized solutions. For instance, in order to manufacture the X-Engine platform for powering small tactical generators ranging from 2-5kW, LiquidPiston, Inc. was awarded Small Business Innovation Research contract by the United States Army.

2018 to 2022 Power Generator for Military Sales Outlook Compared to Demand Forecast from 2023 to 2033

Global sales of power generators for the military grew at a CAGR of 1.9% during the historical period from 2018 to 2022. However, according to Future Market Insights, global power generator for military demand is set to rise at a steady CAGR of 3.6% between 2023 and 2033.

The demand for distributed energy is increasing notably in the military sector. This trend is projected to continue over the coming years in tactical military communications, battlefields, locations, bases, field hospitals, and command systems. As a result, power generator sales in the military sector are set to rise at a significant pace.

Similarly, government spending on military and defense coupled with high demand for reliable power generation sources is projected to bolster military power generator demand.

Several military agencies worldwide are focusing on establishing integrated power systems such as microgrids to accommodate advanced power generators. This is creating a high demand for hybrid generators as they enable users to reduce expenses and carbon footprint.

North America to Remain a Significantly Lucrative Market for Military Power Generator Manufacturers

According to Future Market Insight, North America held around 36.6% share of the power generator for military industry in 2022. It is expected to retain its dominance throughout the projection period.

The robust expansion of the military & defense sector and the rising need for continuous power supply for military applications are key factors driving North America power generators for military market.

North America has become one of the most promising markets for mobile and portable power generators. Military power generators continue to be an area of investment for regional governments.

The heavy presence of leading power generator companies and the growing popularity of environmentally friendly generators and hybrid generators are expected to boost the North American market.

East Asia power generator for military market is poised to exhibit significant growth over the next ten years. Increasing government spending on advanced military equipment and easy availability of technologically advanced power generators at low prices are a few of the factors driving the East Asia market.

Burgeoning Spending on Defense and Military Fueling Military-grade Generator Sales in the United States

According to Future Market Insights, the United States power generator for the military market is forecasted to exhibit a steady growth rate during the forecast period. It is expected to hold around 34.5% share of the global market by 2033.

The rapid expansion of the military & defense sector and the high demand for reliable power-generating resources in military applications are key factors propelling power generators for military sales in the United States.

Similarly, escalating defense spending and the presence of leading power generator manufacturers are expected to boost the United States power generator for the military industry during the projection period.

Since its independence, the United States government has been rigorously spending to strengthen and expand its military and defense sector. However, with recent global developments and rising national security concerns, this spending has skyrocketed. For instance, the United States defense budget and military spending reached US$ 801 billion in 2021, according to the EXECUTIVEGOV. A significant portion of the military budget is spent on equipment required for combat operations.

As a result of the increased defense expenditure, military power generator sales in the country are estimated to rise at a significant pace over the next ten years (2023 to 2033). By the end of 2033, the United States is predicted to hold a massive share of North American power generators for the military market.

Competitive Dashboard: A Closer Look at the Marketspace

To meet the rising demand from the military and defense industry, power generator manufacturers are developing efficient and cost-effective power production technologies. They are putting efforts into producing hybrid generators to increase sales.

HIMOINSA: In October 2022, the company revealed its entire range of diesel generator sets at Bauma 2022.

Kohler Co.: In November 2022, the company completed the extension of its prevailing North American generator manufacturing unit in Mosel, Wisconsin. This project commenced in March 2021 and includes a customer experience centre of 10,000 sq. ft. and a testing, production, and warehousing space of 155,000 sq. ft. The company continues to observe the demand for its integrated power systems and KD Series large diesel industrial generators.

Rolls-Royce Holding plc: In July 2021, the company developed a high-functioning hybrid-electric propulsion system to be used in aerospace.

Cummins Inc.: In August 2022, Cummins Inc. completed the acquisition of Meritor, Inc. Earlier in March 2019, the company launched the HSK78G series of natural gas generators. Each model in this series features efficient gas technology innovations.

Portable Diesel Generator 10kw ©2024 Global Trade. All rights reserved.